Building a diversified stock portfolio is one of the most important things you can do to ensure your financial success. By diversifying your investments, you can reduce your risk and maximize your chances of achieving your financial goals.

Here are some tips for building a diversified stock portfolio:

Start by determining your risk tolerance. How much risk are you comfortable taking with your investments? If you’re not sure, consider speaking with a financial advisor.

Decide on your investment goals. What are you saving for? Retirement? A down payment on a house? Once you know your goals, you can start to build a portfolio that will help you achieve them.

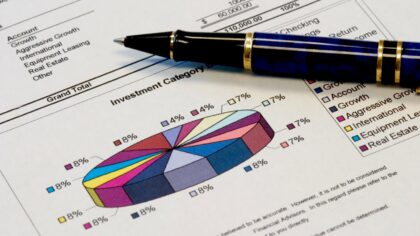

Choose the right asset classes. There are four main asset classes: stocks, bonds, cash, and real estate. Each asset class has its own risks and rewards. Stocks are generally considered to be the riskiest asset class, but they also have the potential for the highest returns. Bonds are less risky than stocks, but they also offer lower returns. Cash is the safest asset class, but it also offers the lowest returns. Real estate is a unique asset class that can offer both growth and income potential.

Diversify within each asset class. Once you’ve chosen the right asset classes for your portfolio, you need to diversify within each asset class. This means investing in a variety of different securities within each asset class. For example, if you invest in stocks, you might want to invest in a variety of different industries, such as technology, healthcare, and consumer staples.

Rebalance your portfolio regularly. As your portfolio grows, you’ll need to rebalance it to make sure it still meets your risk tolerance and investment goals. Rebalancing involves selling some of your winners and buying more of your losers. This helps to keep your portfolio’s risk level in check and maximize your chances of long-term success.

Building a diversified stock portfolio is not a one-time event. It’s an ongoing process that requires regular attention and rebalancing. By following these tips, you can build a portfolio that will help you achieve your financial goals.

Here are some additional tips for building a diversified stock portfolio:

- Consider using index funds or ETFs. Index funds and ETFs are baskets of stocks that track a particular index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds and ETFs are a great way to diversify your portfolio without having to pick individual stocks.

- Don’t try to time the market. Trying to time the market is a fool’s errand. Instead, focus on investing for the long term.

- Stay disciplined. It’s easy to get emotional when the market is up or down. But it’s important to stay disciplined and stick to your investment plan.

Building a diversified stock portfolio is not easy, but it’s worth it. By following these tips, you can build a portfolio that will help you achieve your financial goals.